This is the first post in a series of posts covering digital asset tokenization in financial services, a topic which is seeing tremendous interest in the sector. The series aims to be a guide for financial services customers looking to learn more about the topic, and who may be considering building a digital asset capability for their business on AWS. The series explains key concepts, offers guidance on business case alignment, highlights high level and technical design considerations, and finally presents a reference solution architecture of an illustrative business use case using Amazon Managed Blockchain and other relevant services.

In this initial post we explore core concepts in digital asset tokenization for financial services and highlight applicable business use cases.

Overview of digital asset tokenization in financial services

Throughout this post, the terms “Distributed Ledger Technology” (DLT) and “Blockchain” are regarded as being sufficiently synonymous to simply abbreviate to “DLT” for brevity.

A digital asset in the context of financial services refers to a digital representation (or “digital twin”) of an underlying financial asset. Such digital assets often take the form of digital tokens typically implemented and operated on, but not exclusively, a blockchain or similar distributed ledger technology (DLT). On such a platform, the tokens can be issued, distributed, and traded as financial instruments themselves on a secondary market.

The advent of DLT technology has attracted the attention of many industries, but perhaps none more so than financial services given the disruptive potential of the technology to the sector. Digital asset tokenization is a use case in the industry which aligns exceptionally well with the enabling characteristics of distributed ledger technology.

Industry impact and potential of digital asset tokenization

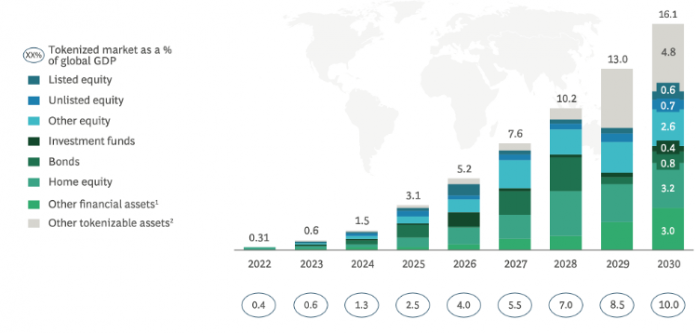

In a 2021 study conducted by Deloitte 76% of respondents saw digital asset tokenization as a significant long term opportunity, with corporate investors (comprising 31% of surveyed companies) reporting significant uptake in digital assets. In another study, 97% of institutional investors agree that “tokenization will revolutionize asset management” and a March 2023 study by Citibank estimates a Total Addressable Market Size of $4-5 trillion for distributed ledger technology (DLT)-based tokenized securities. An analysis by the World Economic Forum (Global Agenda Council) valued the total tokenized market to be 10% of global GDP by 2030:

Fig 1. Tokenization of illiquid assets to be a $16 trillion worth opportunity globally. Source: World Economic Forum – Global Agenda Council, BCG Analysis

With the advent of distributed ledger technologies, a new range of capabilities addressing pain points and new business opportunities within financial services has emerged. Many of these new capabilities involve a new class of assets which are either entirely new native digital assets or digital twins of existing assets and financial instruments. Although not necessarily implemented on DLTs (or similar technology such as centralised cryptographic immutable ledgers), many digital asset providers and institutions have chosen this technology. Many large financial institutions, such as Goldman Sachs, J.P.Morgan, Santander, Societe General, and the European Investment Bank have issued digital asset financial instruments on public DLTs, or are offering new financial products which provide some form of exposure to crypto-currencies or integrate the technology into their existing portfolios. Similarly, digital asset working groups to formulate strategies around DLT technology are now commonplace within financial services institutions.

The transformative potential of digital asset tokenization relates to the fact that the financial services industry has multiple layers of intermediaries and participants in distinct silos but operating on the same data which leads to significant duplication and therefore reconciliation. For example, the existing industry infrastructure supporting post-trade settlement on funds and bonds flow through intermediaries such as Central Counterparty Clearing Houses (CCPs). Such intermediaries exist to reduce counterparty risk and settlement failures by providing a trusted third party to become a counterparty to both sides of a transaction. A technology platform that can offer the same degree of settlement and counterparty risk reduction directly without multiple intermediaries offers significant cost reduction and efficiently gains. Digital asset tokens can directly exploit these benefits as all participants in the token lifecycle can transact directly with the token. In addition, the token itself executes the business logic workflow, without reliance on trusted third parties to govern and execute transactions.

Some business use cases enabled by Digital Asset Tokenization

Cross-border Payments. A token, as a representation of value, is agnostic to political and economic borders and thus can be easily transferred between accounts which are located in different jurisdictions

Regulated Decentralised Finance (De-Fi). By issuing a token on a platform operated by regulated entities employing full KYC/AML controls, innovations such as peer to peer lending/settlement and deposit tokens offered by decentralised finance can be leveraged in a regulated setting. The regulated entities provide the platform but do not function as an intermediatory between issuers and investors.

Central Bank Digital Currency (CBDC). Tokens running on a programmable network representing a unit value held at a central bank. A unit of digital currency represented by a fungible token of currency.

Delivery v Payment (DvP). During settlement of a tokenised trade transaction the smart contract ensures that the security tokens and the payment tokens are swapped simultaneously. This ensures that one party cannot receive the payment without delivering the securities, or vice versa.

Bond, Repo, Euro Commercial Paper Transactions on DLT. Transactions consist with the issuance by the originating institution of a series of tokens on a DLT, where investors purchase and pay for the tokens using traditional fiat.

What is a digital asset token?

A digital asset token represents a transferrable and quantifiable unit of value, or a claim on an underlying asset of value, that exists on an electronic programmable network.

Digital asset tokens can either be native or non-native to the network. A native token is one that is an integral component of the network, with the network serving as its principal record-keeping system. A prominent example of a native token is Bitcoin. Here, the token (Bitcoin) is inherently bound to its originating network, and it cannot exist independently of that network.

On the other hand, a non-native token typically signifies a claim on an underlying asset. A banknote, for instance, provides an apt example of a non-native token. Unlike naturally occurring entities such as gold, a banknote isn’t native to our world. Instead, it embodies a claim on an asset (such as gold) held at a central bank.

Fig 2. A digital asset token comprises of codified rules, behaviours, and data. For example, how to pay a dividend, to whom, and when.

What is tokenization?

Tokenization is the procedure of converting a traditional asset into digital form and subsequently recording it on a programmable platform, such as one enabled by a DLT. However, the value of tokenization goes far beyond the relatively simple digitization of an asset. The fundamental differentiation of tokenization is of “portable representation of value” which refers to how a digital token, secured by cryptography and enabled by a distributed ledger or blockchain, can represent ownership in an immutable, inimitable form and be transferrable between multiple parties in a decentralized network, where trust between participants is not a prerequisite.

Tokens can be generated and are linked to, or symbolize various types of assets such as securities, equity shares, participation certificates, debt instruments, shares of investment collective schemes (commonly referred to as funds), and structured products. Tokenization can rightly be perceived as the transformation of conventional securities into digital assets, commonly referred to as ledger-based securities.

Why digitally tokenize a financial asset or claim?

Despite the advent of electronic trading, global telecommunications and the internet, financial industry market infrastructure exist in silos with distinct tech stacks dating back many decades. Eliminating intermediaries in order to simplify operating models and lower cost, is a key benefit of tokenized representations of financial assets and their corresponding lifecycle. The decentralized nature of DLT networks that often underpin digital asset tokenization platforms enable all eligible participants direct access to the digital representation, without the involvement of intermediaries. Furthermore, tokenization has the potential to significantly improve liquidity for financial instruments which have traditionally proven to be illiquid. Fractional ownership, accessibility of trading infrastructure, execution automation and programmability (using smart contracts), transparency and interoperability across DLT networks all contribute to enhanced liquidity. This, in turn, can lead to price stabilization, settlement and counterparty risk reduction, transaction cost reduction, and reduced friction around price discovery and trading.

Fractional ownership is probably the fundamental innovation tokenization brings. For example, investors in a tokenised bond would no longer be bound to the face value of a bond; for example, a $100,000 bond would become 100,000 units/tokens of $1, thus providing fractional ownership and increasing illiquidity to a broader base of potential investors.

It is important to note that not all financial products are suitable for tokenization. Assets like fixed income and private equity are more constrained compared to the efficient public equities market as it stands today. It is therefore key to ensure the asset class being considered for tokenization is suitable and the benefits of tokenization are likely to be realized.

What is a digital asset tokenization platform?

A digital asset tokenization platform converts rights to an asset into a digital token onto a digital and programmable platform which manages the progression of the token through its business lifecycle. The state of the token is maintained on a shared multi-party ledger which is accessible to entitled participants. Participants may transact directly with each other on the platform for example, issuers transacting directly with investors, direct peer to peer trading across secondary markets, regulators monitoring transactions in real-time and settlement services executing directly on the platform, as illustrated in the following diagram:

Fig 3. The traditional method for managing financial asset lifecycles involves a “duplicated system of record.” In this approach, all participants keep duplicate data in separate databases. Because of the ongoing risk of data errors, these databases need frequent reconciliation. The registry, or ‘golden record’ of the asset is stored by a centralised intermediatory such as a Central Security Depositary (CSD). Data is accessed by the various participants involved in the asset lifecycle, such as investment banks, corporate investors, private investors, funds, and custodians (and others service providers such as CSDs) through Application Program Interfaces (APIs). With a decentralized tokenization platform, the programmable tokens are codified on a shared platform with no single centralized entity having overall control, and all participants having direct access to the asset they are eligible to transact with thus eliminating the need for intermediaries. The state of the digital asset, for example current owner, is an attribute of the token itself – not a data record maintained by all participants.

Digital asset ‘smart contracts’ are an intrinsic attribute of a token on the platform, codifying token behaviour and enabling automation of the business lifecycle events. The quality, reliability, consistency and auditability of a digital asset tokenization workflow implementation is therefore critically important to ensure regulatory, contractual, and compliance standards are met – perhaps more so than with conventional approaches, due to the characteristic immutability and automation of the platform. The programmability of the token’s lifecycle on the platform leads to another benefit of ‘composability’ which refers to the ease by which smart contract of differing tokens can interoperate seamlessly to build innovative financial product. For example, if two different tokens are created using smart contracts which know how to interoperate with each other, the tokens can be easily swapped thus forming a financial swap instrument. Similarly, one token could be programmed to be equivalent in value to a number of other known tokens forming a structured hierarchy of tokens, the exact structure of which is being configured to achieve a specific business goal or end-client requirement.

The lifecycle of a digital asset token, representing a claim on an underlying asset, generally follows the same lifecycle as conventional security processing; namely origination, issuance and distribution, trading, clearing, settlement, and maturity. However, a token-based platform will differ in some key regards:

The platform is more decentralized – there is no, or considerably less centralised entities, which govern the platform. Token ownership, for example, can be transferred directly between participants on the platform without passing through a central entity.

With traditional centralized ledgers, the services which comprise the operation of a security; for example; custody settlement, escrow, collateral, and regulatory actions are distinct processes which are executed by various agencies running their own applications and databases. The attributes of the security, such as the owner, the custodian, the identification, the issuance value, are represented by duplicated and distributed data records across the network. A tokenization platform however, codifies these fragmented and siloed data records into a programmable unit which can exist in a distinct form on the platform. The token’s lifecycle is operated in an automated manner in response to events originating externally to the platform.

The following lists the key lifecycle stages and how a tokenized asset can benefit from these stages executed by a tokenization platform:

Origination and issuance process can be significantly automated by smart contract, reducing time and cost.

Trading can execute in real-time directly between counterparties on the same platform, further reducing capital requirements, counterparty risk, and settlement times.

Settlement and clearing time is reduced and processes streamlined, drastically reducing errors and costly reconciliation and exception processing workflows.

Servicing could be programmed via a smart contract to auto-trigger pay-outs for corporate actions. In the case of loan securitisation, borrower repayments could be pooled and distributed to investors via token smart contracts.

Fig 4. A digital asset token exists on the platform and transits various states aligned to the business workflow. Its state is visible to all eligible participants. Benefits at each stage are illustrated.

Conclusion

In this post, we explored the fundamental concepts underpinning digital asset tokenization within the realm of the financial services industry. Common reasons for building a platform to facilitate digital asset tokenization were highlighted, and how the traditional asset lifecycle is disrupted and enhanced using tokenization.

In conclusion, digital asset tokens can take many forms, from tokenised credit cards on a cellphone, to a multi-million-dollar bond on the public Ethereum DLT. It is important to realise a DLT is not a pre-requisite for enabling tokenization, it is one facilitating technology that has the potential to fulfil many of the aspired benefits of tokenization. It is critically important to carefully consider the asset’s attributes and operational mechanisms when considering tokenization, as different types of asset may yield differing degrees of benefit. Assets with little manual intervention, a clear legal framework, and clear regulation have a higher chance of capturing the various benefits of tokenization.

In the next part in the series, we will look into the considerations involved in envisioning a tokenisation framework on AWS and present potential solution architectures on key aspects. In addition, the benefits of using a manged blockchain service, such as Amazon Managed Blockchain will be discussed. Newly launched capabilities such as Amazon Managed Blockchain Query and Amazon Managed Blockchain Access provide actionable real-time data across different blockchains with standardized APIs. For example, a tokenization architecture would utilize Amazon Managed Blockchain Query to extract token balances, transactions, and token events from the Ethereum blockchain in real-time, enabling rapid integration with actionable analytics and applications. Amazon Managed Blockchain Access provides public blockchain nodes for Ethereum and Bitcoin, as well as the ability to create private blockchain networks with the Hyperledger Fabric framework. These capabilities enable developers and architects to focus on differentiating innovation rather than node hosting infrastructure which offers significant architectural acceleration when planning and implementing a tokenization architecture.

About the author

Steven Bacci is a Principal Specialist Solution Architect within the Worldwide Specialist Blockchain/Web3 team at Amazon Web Services. He works closely with the product and engineering team for Amazon Managed Blockchain, advising customers globally on business case alignment, technical architectural designs, and application engineering for Blockchain and Web3 solutions with a specific focus on the financial services sector.

Read MoreAWS Database Blog