Broadridge Financial Solutions (NYSE: BR), a global Fintech leader with more than $5 billion in revenues, provides the critical infrastructure that powers investing, corporate governance, and communications to enable better financial lives. We deliver technology-driven solutions that drive digital transformation for banks, broker-dealers, asset and wealth managers and public companies. Broadridge’s infrastructure serves as a global communications hub enabling corporate governance by linking thousands of public companies and mutual funds to tens of millions of individual and institutional investors around the world.

In this post, we share how Broadridge used Amazon Managed Blockchain to build a private equity lifecycle management solution.

Solution Overview

Broadridge began experimenting with blockchain technology in 2018, building prototypes and pilots to test various use cases and blockchain frameworks. Through this experimentation, Broadridge identified that the most successful blockchain projects were built with customers or partners who adopted the solution from the start. Broadridge has since formalized this blockchain experimentation and development effort within a Blockchain Center of Excellence, where they can actively participate in regulatory and industry initiatives, build solutions that solve current customer challenges, and closely monitor the latest innovations in the industry.

The Blockchain Center of Excellence has helped Broadridge launch several blockchain projects, of which two have been launched in production: Shareholder Disclosure Hub and Private Market Hub. In this post, we focus on Private Market Hub, which uses the fully managed Hyperledger Fabric network offering of Managed Blockchain to facilitate efficient private equity fund administration between the many counterparties involved.

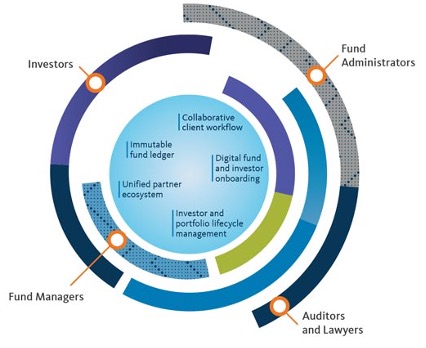

The Private Equity Fund Administration lifecycle today is characterized by complex, often manual, time-consuming processing between many disparate entities, as shown in the following figure. These entities, such as fund managers, investors, auditors, lawyers, regulators, banks, and more, must converge on a set of rules and agreements to finalize a given transaction. Facilitating agreement between fragmented systems and entities presents efficiency challenges that can negatively impact the investor experience and introduce unnecessary delays in the private equity lifecycle.

As a technology, blockchain is well suited to facilitate consensus among a group of distributed participants and converge on an agreement to a set of rules for a transaction. Broadridge therefore used blockchain in their platform to provide fund administrators with the following benefits:

Improve efficiency and reduce costs by automating production of investor correspondence

Increase transparency and accuracy of data by engaging clients directly in their business transactions

Dramatically reduce processing cycles from days to hours

Give clients access to business data throughout the fund lifecycle

Administer funds in different jurisdictions via a single, unified user interface

Integrate data and workflows with existing legacy back-office technology, and act as a bridge between multiple GL systems

Automate audits of client’s funds, leading to dramatic reductions in audit cycles

With Private Market Hub (PMH), Broadridge built a unified platform that enables the many entities involved in private equity transactions to more readily share information in near-real time, reduce processing cycles, and improve the investor experience. Rather than iteratively reaching agreement between multiple organizations by passing documents around, Private Market Hub facilitates agreements directly between the counterparties, reducing instances of fragmentation where one entity is unaware of a transaction’s status at any given point in the process. On the blockchain, these entities can share critical subsets of data pertaining to a private equity transaction in near-real time, while storing the larger format data in a traditional database.

At the foundation of Private Market Hub, Broadridge utilized Managed Blockchain to deploy private, permissioned blockchain networks using the Hyperledger Fabric framework. Managed Blockchain provides a fully managed blockchain infrastructure capable of supporting production workloads, allowing Broadridge to shed the undifferentiated heavy lifting of provisioning and managing the underlying compute, storage, networking, and services required to operate a Hyperledger Fabric blockchain network. This freed up resources to build critical features such as a CI/CD pipeline and a decoupled blockchain integration service API, as well as refine critical components of their data model and encryption mechanisms to meet compliance requirements. As shown in the following high-level architecture diagram, the Private Market Hub stack relies on a three-tier model, with the web (interface) layer, application layer, and data layer.

Due to requirements with how data is domiciled, Private Market Hub is built upon two separate Hyperledger Fabric networks in both Europe (eu-west-2) and the US (us-east-1). In blockchain applications, not all data that pertains to a given process must be written to the blockchain, which necessitates the use of an off-chain database to store additional data not shared between entities on the blockchain. Both Amazon DynamoDB and Amazon Aurora provide NoSQL and SQL databases for off-chain data, such as audit event data. The blockchain integration service, which sits in the application layer, is a vital component of the architecture. It facilitates asynchronous interactions with the blockchain, where an Amazon Simple Queue Service (Amazon SQS) queue accepts messages that correspond to blockchain transactions, and those messages are processed in the blockchain integration service before responding to the end-user after the transaction is finalized on the blockchain. This is a critical component to manage the variation in block time on Hyperledger Fabric, which determines the point at which a given write transaction reaches finality. Compared to a traditional database, the overhead of consensus on a blockchain means that this finality can take up to a few seconds. The following diagram illustrates this workflow.

Using an API-first design that decoupled the blockchain capabilities from the rest of the architecture through the blockchain integration service gave Broadridge the agility to adapt to changing requirements, such as adding additional members to Private Market Hub.

The Hyperledger Fabric blockchain framework serves as the mechanism for the many entities involved in the private equity lifecycle to more readily share data and reach agreement on a given transaction, creating gains in efficiency. Business logic expressed in code, called chaincode in Hyperledger Fabric, is run to facilitate this process. Chaincode is what defines business logic for how data is written to and read from the blockchain ledger, and it allows for business logic to be expressed and executed transparently between members of the blockchain network. Additionally, chaincode can be written to continuously expand the functionality of the Private Market Hub platform over time.

Key learnings

Broadridge identified several key learnings from the development of Private Market Hub, which can be applied to a broad set of private blockchain use cases and implementations. First, by considering the data locality and encryption requirements of a blockchain application early in the design process, they can avoid complex re-architecture activities during and after development. Furthermore, building blockchain applications with an API-first design provides the flexibility to expand functionality over time. Additionally, designing patterns for cross-Region failover and backup and restore can help meet compliance and application resiliency requirements. Finally, building a Blockchain Center of Excellence allowed Broadridge to closely track what was happening in the blockchain industry, build partnerships, and build the necessary proofs of concept to deliver blockchain workloads in production.

Conclusion

In this post, we shared how Broadridge used Managed Blockchain to build a private equity lifecycle management solution that addresses the inefficiencies entities face with the manual, complex processes required to facilitate private equity transactions. We also described the key learnings and architecture patterns Broadridge employed to build Private Market Hub, a successful production implementation of blockchain on AWS. To learn more about Managed Blockchain and other customer success stories, explore the AWS Database Blog.

About the Author

Forrest Colyer is a Manager Web3/Blockchain Solutions Architect at AWS. He has 8 years of experience working alongside customers on both private blockchain solutions led by consortia and public blockchain solutions that address use cases related to NFTs and DeFi. Forrest works directly with technical and business stakeholders to identify blockchain use cases and implement high-impact blockchain solutions.

Read MoreAWS Database Blog